WHAT IS RESPONSIBLE INVESTING?

Responsible investments (RI) implies that investors consider environmental (E), social (S) and corporate governance (G) factors in their investment decisions and are active owners working to influence companies to improve their sustainability performance. The amount of responsibly invested capital has grown rapidly over the past decade, up to 30% per year, and the share of capital managed with some form of RI methodology represented 30% of professionally managed capital in 2014 (Eurosif, 2014). The share is significantly higher in Sweden, which is often seen as a leading country globally.

WHY ARE INVESTORS FOCUSING ON RI?

Investors’ primary objective is to achieve healthy risk-adjusted return and there are several reasons why investors focus on RI:

- Perception that RI contributes positively to risk-adjusted returns through analysis of material risks and opportunities related to corporate sustainability performance. RI enables better investment decisions through more comprehensive information, which affects long-term returns. In this case, RI is part of the investor’s primary mission.

- Awareness that lack of RI may pose risks to the investor itself, e.g. damaged reputation or poor financial performance.

- Aim to combine values and investment philosophy within E, S and G, e.g. contributing to a better environment by excluding fossil fuel companies.

Regardless of motive, the objective for responsible investors is to use invested capital to influence businesses to operate more sustainably.

“It makes no sense to invest in companies that undermine our future”

Desmond Tutu

HOW ARE INVESTORS WORKING WITH RI?

ESG considerations can be addressed in different ways and investors often use multiple strategies to achieve the desired sustainability impact and returns. There are three overarching approaches:

- Exclusion of companies that violate international standards and conventions or operate in certain industries or geographies.

- Inclusive selection of companies that are successful in their sustainability efforts, e.g. best in class, working in sustainable industries or have an offering that aims to disrupt industries towards sustainable development.

- Active ownership through voting and direct contact with companies to influence change on ESG issues.

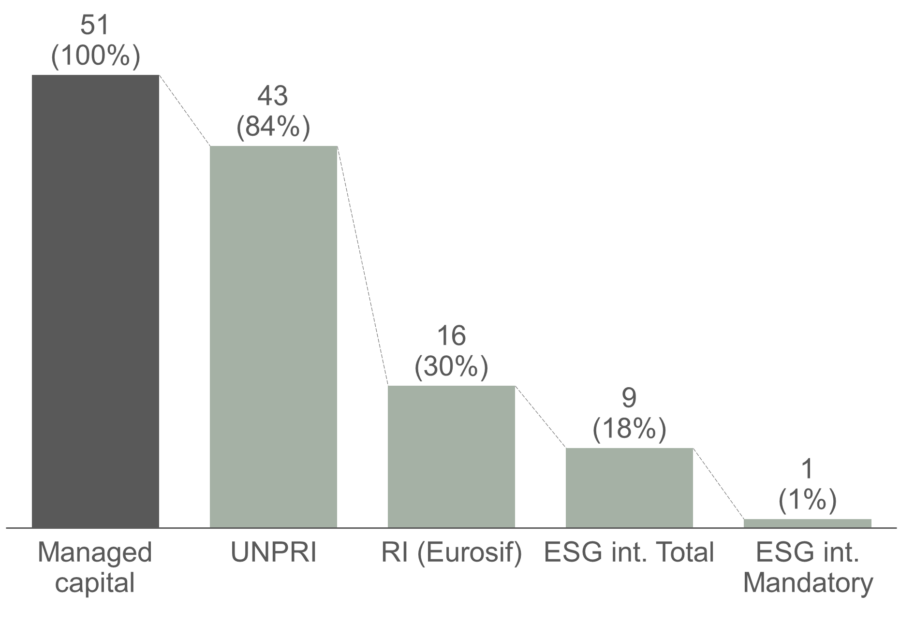

LEVEL OF AMBITION DRIVES THE AMOUNT OF CAPITAL

The amount of capital that can be classified as responsible depends on the level of ambition and decreases as compliance requirements increase, see Figure 1. UNPRI sets relatively high standards and includes the investor’s total capital regardless of if it is responsibly invested or not. Therefore, by many, UNPRI’s requirements for RI are not considered practical enough.

Mandatory ESG integration, a more concrete definition, means that ESG factors always are included in investment decisions, but there is no requirement as to what or how much information should be included. Despite this, only 1% of assets under management are covered by this definition.

IDENTIFIED CHALLENGES AND ACTIONS

Despite the progress in the field of RI, a lot remains to be done. Axholmen, in dialogue with more than 60 leading European asset owners and asset managers, has identified three key actions to take RI to the next level.

Increase transparency. There is a general lack of transparency in asset management, making it difficult for asset owners to distinguish the level of ambition and capabilities of asset managers. RI is differentiating for asset managers and marketing does not always show what is actually being done and it is often difficult for asset owners to determine what they are getting in terms of actual RI work. The information gap needs to be reduced, which requires improved monitoring through ongoing ESG reporting from asset managers to asset owners.

Encourage ambitious alternatives. Ambitious RI processes cost both time and money to implement. Ambitious asset managers need to be rewarded and given the opportunity to make their work visible to asset owners. Various benchmarks, such as the Morningstar Sustainability Rating, play an important role here. However, the transparency of the parameters on which the rankings are based needs to be improved so that more investors can see the benefits of these benchmarks.

Establish a quality-assured minimum level of RI. Successful actors, often with the necessary resources, are continuously improving and raising the bar. However, there is no concrete minimum level, and many investors are at the beginning of their RI journey and need to be given the opportunity to work cost-effectively on RI. By working together, asset owners can align interests and put higher demand on managers’ RI processes, analysis and work as active owners to drive real change.